Editorial: Filipinos Only Care About Cybersecurity When Money Is on the Line

Filipinos are some of the fastest adopters of digital tools in Southeast Asia. We bank online, pay through QR codes, send cash gifts via e-wallets, and even earn through digital platforms. Yet, behind this convenience lies a hard truth: we only start to care about cybersecurity when money enters the conversation.

Take what happened when Deep Web Konek reported an issue affecting GCash systems last year. The post spread like wildfire. Everyone suddenly became a “cyber expert” overnight commenting, sharing, demanding answers. When there was an alleged breach on GCash, it dominated online discussions for days. People posted screenshots of suspicious transactions, exchanged safety tips, and called out the company. It was chaos, but productive chaos. People cared because their money was on the line.

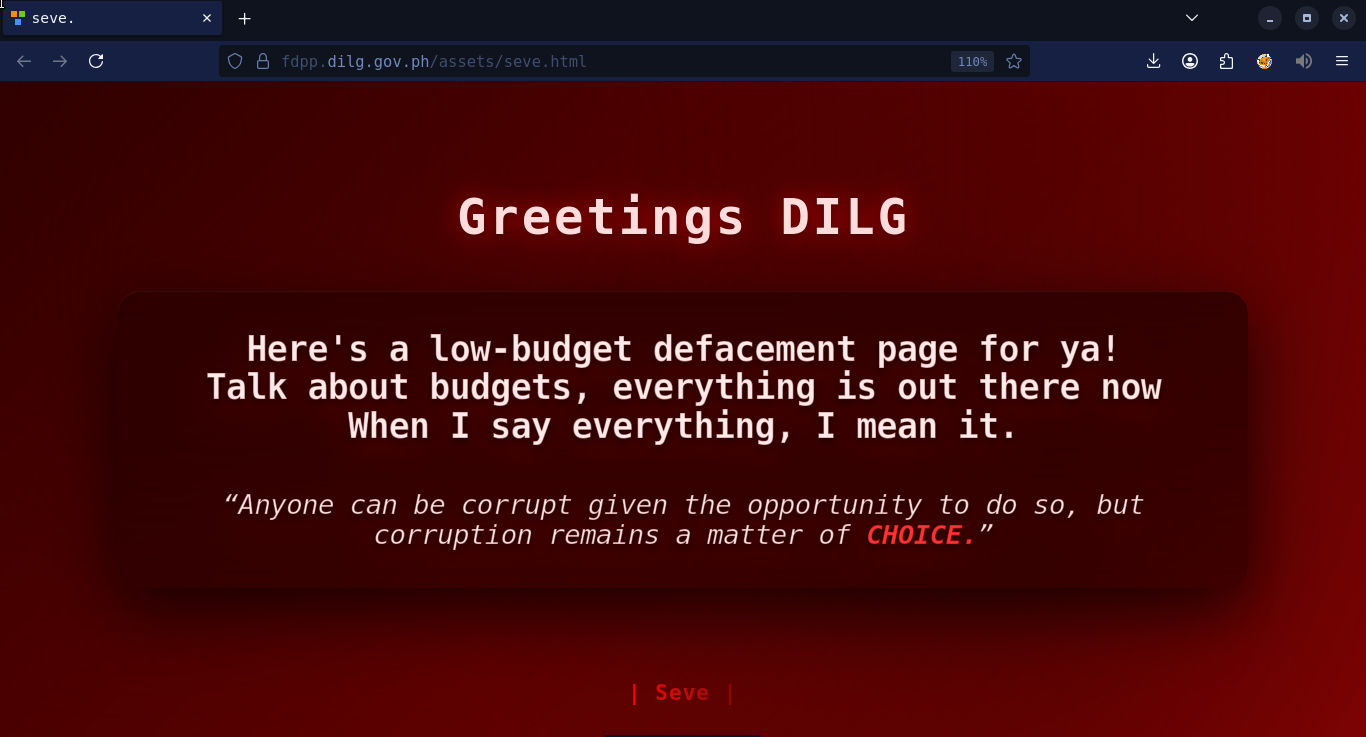

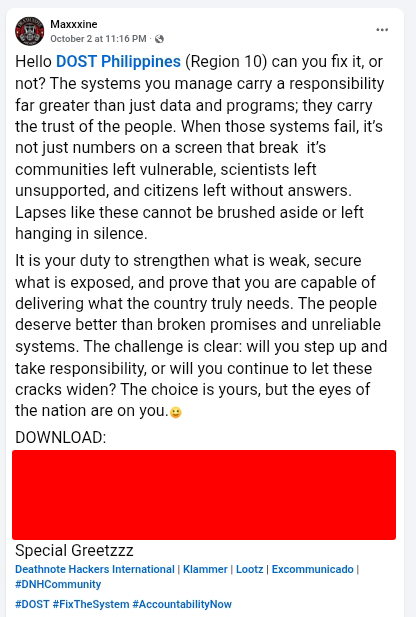

But when the issue was resolved, and attention shifted elsewhere, discussions about cybersecurity went quiet again. When Deep Web Konek or other researchers publish findings about government domains being breached or databases leaking personal information, incidents that could lead to identity theft, scams, or profiling, the response is nowhere near the same. Few shares, fewer comments. Why? Because no one’s balance was deducted.

It’s a reflection of a cultural pattern that has long existed: Filipinos tend to act after the damage is done. Cybersecurity awareness is reactive, not proactive. We wait until something breaks, until someone gets scammed, before taking it seriously. The same attitude applies online. We treat cybersecurity like fire insurance — important only after the fire.

This mindset is shaped by several realities. First, the bahala na mentality — that deep-rooted belief that “nothing bad will happen” — persists even in our digital lives. Many users reuse the same password across multiple apps, or click suspicious links just to claim a promo. It’s easier to assume we’re safe than to learn how to be safe.

Second, there’s the issue of digital literacy. Most schools still focus on teaching how to use technology, not how to secure it. Young people know how to create content but not how to protect their data. Older generations, meanwhile, are more vulnerable to scams because they trust too easily. Cybercriminals know this — and they exploit it.

Third, we treat online safety as someone else’s responsibility. When a breach happens, people blame companies and government agencies — often rightfully so. But personal accountability rarely enters the discussion. Even with built-in security features like OTPs, biometrics, and fraud alerts, users continue to share sensitive data, ignore warnings, and use unsecured Wi-Fi. We expect technology to protect us, yet we refuse to do the bare minimum to protect ourselves.

Filipinos must understand that cybersecurity is not just about pesos and e-wallets. Every piece of personal information — your full name, birthday, phone number, and even your selfie — has real market value in the dark web. In fact, according to Deep Web Konek’s own dark web intelligence findings, each Personally Identifiable Information (PII) record can be worth more than $50, depending on how complete it is.

Imagine this: your government ID, scanned and uploaded during an online KYC process, can be sold alongside your phone number and email. That single digital footprint can allow cybercriminals to open fake bank accounts, apply for loans, or impersonate you in scams. The hacker doesn’t need your e-wallet PIN — they already have your identity.

Yet when data breaches happen, people often shrug. “Wala namang nawawala sa account ko,” many say. But that stolen data doesn’t need to empty your account today — it could be used next year, in another scheme, under another name. The problem with digital theft is that it’s silent. You don’t hear the break-in, but the consequences linger long after the headlines fade.

If we are to grow as a digital society, these are the truths we must confront.

First, do we only value cybersecurity when it affects our wallets? If yes, then we are learning the wrong lesson. Security should begin long before the scam happens — not after. It should be part of every login, every click, every app we use.

Second, why do we ignore warnings that don’t involve money? A leaked email database, an exposed school portal, or a compromised government website may not touch your savings — but it exposes the entire system we rely on. Today it’s a school, tomorrow it’s a bank. We can’t wait until the breach reaches our accounts to take it seriously.

Third, are we treating our data like the currency it truly is? If one PII record costs $50 to a cybercriminal, how much would your entire online life be worth? What if your identity — your name, birthday, address, and selfie — could be sold for hundreds of dollars? Would you still give your details so freely online?

Fourth, are we contributing to awareness or apathy? Every time we scroll past a cybersecurity update because “it’s too technical,” we reinforce the culture of ignorance that hackers depend on. We can’t claim to care about safety only when trending topics involve lost e-wallet funds. Real awareness means paying attention even when it doesn’t trend.

To be fair, things are improving. Financial fear has become a strange but effective teacher. Filipinos are learning to activate app locks, enable biometrics, and verify suspicious messages. Institutions have responded with stricter authentication systems and better fraud alerts. Awareness is rising — but it remains shallow, limited to whatever threatens our wallets.

True digital maturity means going beyond that. Cybersecurity isn’t just a technical matter; it’s a social one. It’s about how much we value our privacy, how responsibly we use our devices, and how we protect one another online. In a connected world, your negligence can put others at risk — a compromised account, a shared scam link, or a data leak doesn’t end with one person.

If Filipinos can learn to treat cybersecurity as part of daily life — like locking a door or wearing a seatbelt — we could prevent more breaches than any law or system ever could. But that requires a change in mindset. We must stop viewing cybersecurity as optional, or as something relevant only to experts or victims. It concerns all of us.

Filipinos care about cybersecurity — but only when their wallets are at stake. It’s time we care when our identities are at stake too. Because in the eyes of cybercriminals, a single piece of personal data is worth more than fifty dollars — and in the wrong hands, it’s priceless.

So before you click that link, share that file, or ignore another cybersecurity alert, ask yourself: If my personal data were a hundred-peso bill, would I still hand it to a stranger?

Cybersecurity begins with that kind of thinking — not when we lose money, but when we finally understand that everything we are online has value worth protecting.